Policy Corner: 2022 Was a Big Legislative Year for Affordable Housing- What’s Next?

2022 has been a landmark year for affordable housing policy in Colorado. Roughly 15 relevant affordable housing bills were passed during this year’s Colorado Legislative Session, addressing a range of issues from housing development to mobile home park stability. According to the Neighborhood Development Collaborative (NDC), a community development corporation composed of 20 Metro-Denver housing nonprofits including Urban Land Conservancy (ULC), these are the key takeaways from this transformative session:

2022 has been a landmark year for affordable housing policy in Colorado. Roughly 15 relevant affordable housing bills were passed during this year’s Colorado Legislative Session, addressing a range of issues from housing development to mobile home park stability. According to the Neighborhood Development Collaborative (NDC), a community development corporation composed of 20 Metro-Denver housing nonprofits including Urban Land Conservancy (ULC), these are the key takeaways from this transformative session:

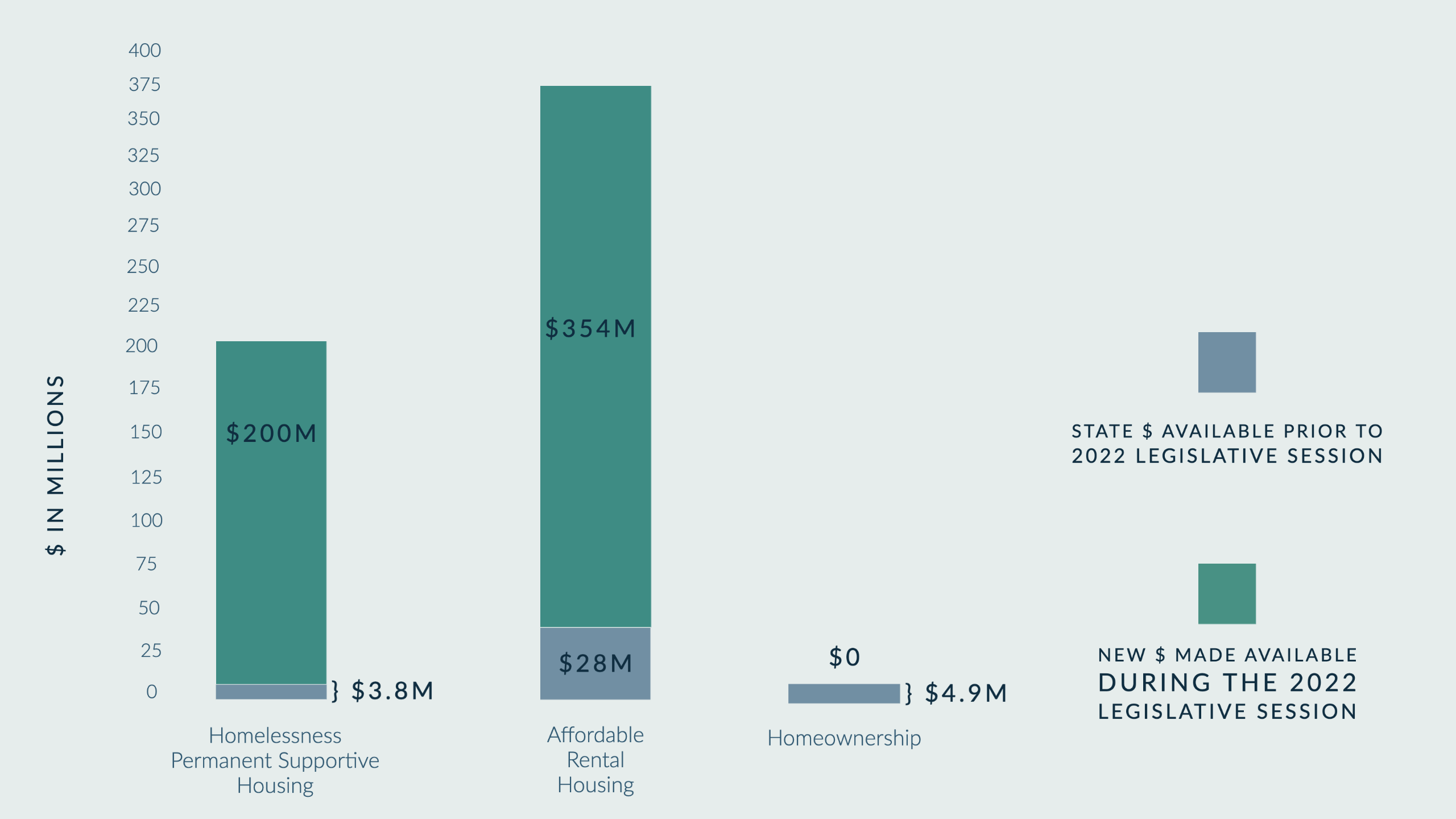

New Funding: Overall, excluding bills that rely on bonds, tax credits, or incentivize local jurisdictions to create pro-housing policies, this legislative session created approximately $629M in new affordable housing funding that will be administered through grants and loans. This is one time funding and is not a recurring source of revenue for affordable housing in Colorado.

Grants: New, much needed affordable housing grant programs, including HB22-1304, will provide $168M to nonprofits and local governments for affordable housing programs across the state. The Infrastructure and Strong Communities Grant Program will provide $40M to local governments to implement sustainable land use best practices to accommodate more affordable housing within our existing infrastructure.

Loans: With the passing of SB22-159, affordable housing creators will have access to a newly created revolving loan fund. NDC, ULC, and other affordable housing providers believe this to be a critical step towards addressing the affordable housing shortage, as it creates a $150M loan fund.

“Missing Middle” Focus: Legislators are increasingly concerned about housing for the “missing middle”— people who earn above the area median income, but still can’t afford rising housing prices in Colorado. Every non-homelessness focused housing development bill introduced this session, such as SB22-146, that is not specifically aimed at reducing homelessness will serve households earning above the median income.

ARPA-Funded Bills: There has also been a bigger focus on the homelessness crisis this session. HB22-1377, HB22-1378, and SB22-211 are all specifically geared toward creating permanent supportive housing and other resources for people experiencing homelessness. Overall, $200M (not including the tax credit) will be available to provide housing and services for Colorado’s unhoused population.

Mobile home parks saw two bills passed, SB22-160 and HB22-1287, that will provide residents with funds to purchase their mobile home parks and create more protections for residents against rent hikes, damages, and evictions, respectively.

More to Consider: The sheer number of new programs passed this year will elevate the administrative burden shouldered by the Colorado Division of Housing (DOH) and other state entities, which could lead to funding delays for affordable housing initiatives. We recommend that the state use the Colorado Housing Finance Authority (CHFA) and private entities to assist with timely distribution of funds in a highly competitive and fast moving housing market. Additionally, advocates need to propose balanced middle-income housing solutions to avoid the cannibalization of other programs and funding needed to serve lower AMIs.

Tax Credits: While the two major tax credit bills HB22-1051 (extends the state housing tax credit to 2034) and HB22-1083 (Colorado Homeless Contribution Income Tax Credit)

did pass, pressure to reduce both bills ultimately led to the State Housing Tax Credit proposal being cut $15M to $10M and the Homelessness Sales Tax proposal duration being reduced to just 4 years.There is a growing resistance to utilizing tax credits, as exemplified by cuts to funding and duration of these programs, and yet they are tried-and-true critical resources for creating affordable housing, especially multi-family housing.

More to Consider: Demand for affordable housing is far outpacing supply and adequate planning & coordination of such, and the federal Low Income Housing Tax Credit (LIHTC) program certainly isn’t keeping up with demand. So, state tax credit programs are needed to help fill the much-needed gaps. It is expected that by 2031, over half a million LIHTC-assisted homes will reach the end of their affordability restrictions. To brace against the onslaught of private equity companies buying up tax credit properties at their expiration, we must increase tax credit programs.

Colorado has been successful at leveraging state tax dollars to expand affordable housing. Since 2014, their program has created and preserved over 8,000 affordable homes across the state. And yet, it’s not enough. Our state has 30 rental homes for every low-income renter/household, and nearly 1 in 4 households is extremely cost-burdened paying more than 50% of its income toward rent (CHFA). We need to continue to fight for this tried-and-true resource to create and preserve more affordable housing.

Incentives: With the passing of HB22-1282, the Innovative Housing Incentive Program, $40M in funding will go out through grants and loans to small businesses to incentivize development of manufactured homes. Additionally, within HB22-1304, a $40M set aside for the Infrastructure and Strong Communities Grant program, is meant to incentivize local governments to support local affordable housing projects through zoning change and other levers.

More to Consider: Affordable housing challenges need innovative and diverse solutions. While housing development incentives can increase the supply of housing and improve housing affordability, we caution a careful assessment of each incentive, evaluating them against the cost of meeting specific affordable housing requirements.

Looking Forward: While we are excited about the resources now dedicated to affordable housing, there is still more work to be done, namely:

Our state would benefit from a State Housing Plan to guide and coordinate future strategies, especially as we face an ongoing lack of funding after this one-time money is expended

Advocates need to propose balanced middle-income housing solutions to avoid cannibalization of other programs and funding needed to serve lower serve lower income families who undoubtedly bore the brunt of the pandemic

More focus must be trained on homeownership to go far enough to support low-moderate income Coloradans struggling to buy homes, especially in rapidly gentrifying areas.

Please contact Jonathan Cappelli, Executive Director of Neighborhood Development Collaborative, to learn more about the Collaborative’s work and positions. He can be reached at jonathan@ndcollaborative.org.